Each lender advertises its respective payment limits and loan dimensions, and finishing a preapproval process can give you an idea of what your curiosity charge and monthly payment could well be for this kind of an sum.

By using an internet based lender to make an application for $3000 loans, you happen to be giving yourself the instruments needed to locate the ideal fast loan opportunities Which might be less costly than other choices obtainable. Utilizing the companies of pawn shops, car or truck title loan facilities, and/or PayDay loan corporations, may be a rapidly choice, having said that, it could pose an unneeded risk to shedding a car or truck or beneficial goods.

CNBC Select rounded up some individual loan lenders that allow you to submit an application for as tiny as $three,000. We checked out critical aspects like interest premiums, charges, loan amounts and term lengths available, in addition other attributes together with how your money are dispersed, autopay bargains, customer service and how briskly you can get your money. (Browse more details on our methodology underneath.)

Normally, the for a longer period the time period, the greater curiosity are going to be accrued after a while, increasing the overall expense of the loan for borrowers, but cutting down the periodic payments.

Except for mortgage loan provides, this compensation is one of various factors which could impression how and exactly where provides look on Credit history Karma (including, as an example, the buy where they appear).

Almost all loan structures incorporate fascination, and that is the profit that financial institutions or lenders make on loans. Interest fee is The share of the loan compensated by borrowers to lenders. For many loans, desire is paid As well as principal repayment. Loan fascination is usually expressed in APR, or annual percentage price, which includes each curiosity and fees.

Can you get a $three,000 loan without credit rating? $3000 loans can be accessible to individuals with no credit history or poor credit history, these solutions likely will come with greater desire rates, service fees, or simply the need to offer collateral to get authorised.

This may be achieved through the five C's of credit score, which can be a common methodology used by lenders to gauge the creditworthiness of potential borrowers.

Even though CNBC Find earns a Fee from affiliate associates on numerous gives and inbound links, we create all our written content without having enter from our professional group or any outdoors third events, and we satisfaction ourselves on our journalistic expectations and ethics.

Even In case you have a A great deal larger credit score score, you can nevertheless locate it hard to qualify For those who have a substantial financial debt-to-earnings ratio or perhaps a recent personal bankruptcy in your credit report.

Set-level APR: Variable check here costs can go up and down more than the life span of your loan. With a set rate APR, you lock in an fascination price for that period from the loan's expression, which means your regular payment will not likely range, creating your funds much easier to strategy.

And even though there are not any penalties for having to pay from the loan early, there is a late payment that should run you $30 or up to 15% (based upon your state).

The operator of the website isn't a lender and doesn't make loans or credit decisions. This Web-site would not constitute a suggestion or solicitation to lend or deliver funding. This website will post the knowledge you offer to a number of funding associates.

A number of the commonest makes use of for private loans consist of debt consolidation and home enhancement. Continue reading to find out the ins and away from acquiring a $three,000 private loan.

Jake Lloyd Then & Now!

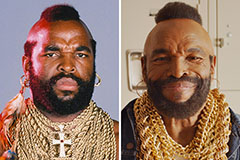

Jake Lloyd Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!